See what sets Taylor apart with everything from cost savings, supply chain stability and compliance expertise to omnichannel communications and the platforms to deliver them.

The critical communications workflow is one of the most complex business processes. Work with a partner that can help you flawlessly compose and deliver your customer communications.

For more than 50 years, Taylor has helped organizations deliver customer communications

with the highest levels of accuracy, security and compliance. Many of them are brands

you interact with every day.

CCM interactions happen through a wide range of functions and phases. Each one is an important piece of the customer communications journey.

Taylor has a pair of businesses dedicated to providing organizations with end-to-end

customer communications solutions: Neps™ and Venture Solutions™.

Neps collaborates with you to develop the best designs, version controls and personalization methods for your critical communications.

CAPABILITIES

Venture Solutions works with you to produce and deliver secure and personalized communications through synchronized channels.

CAPABILITIES

Unlike direct mail and commercial printing, CCM has many unique factors and risks surrounding regulatory compliance, data security and mailing accuracy.

Customer data and personal information must be safely stored and transmitted. This requires intense security measures such as encryption, firewalls and multi-factor identification. In addition to data protection, businesses must stay compliant with government, industry and internal regulations.

In addition to the protection of sensitive data, CCM ensures that businesses provide their customers with critical information at the right time and through the right channel.

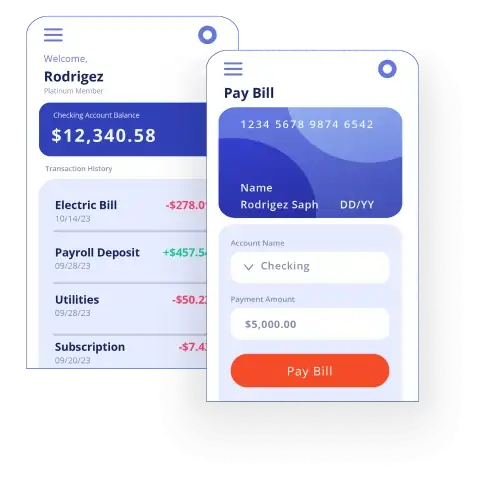

Customers expect to be able to switch from one channel to the other when viewing their personal information and when they receive other personalized communications. The digital platforms needed to deliver an omnichannel experience are now more important than ever for CCM.

When you are looking for customer communications management software, you need a

recognized leader with a reliable and proven platform.

Neps provides all the services and solutions you need to prepare your files for production.

Synchronize all of your customer-facing communications.

Simplify your workflow by consolidating documents where you can.

Find the right placement, phrasing, fonts, styles and more.

Deliver a seamless customer experience with a synchronized print and digital output.

Improve readability and eliminate redundancies.

Control the design and delivery of your content from anywhere.

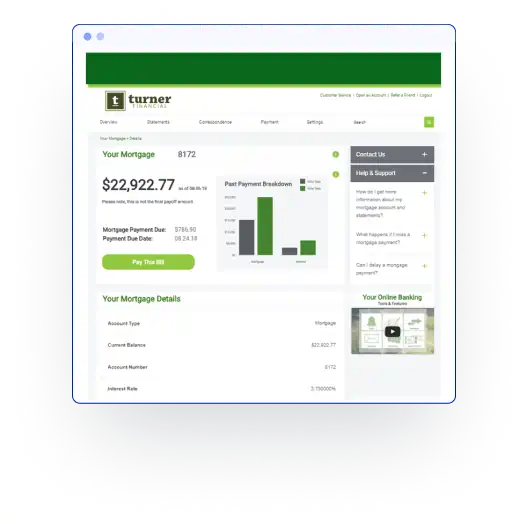

Venture Solutions specializes in the secure delivery of your sensitive documents. Here you’ll

have total transparency and control of your customer communications.

Choose the solution that best meets your needs.

Digitization saves you money and increases accessibility for your customers.

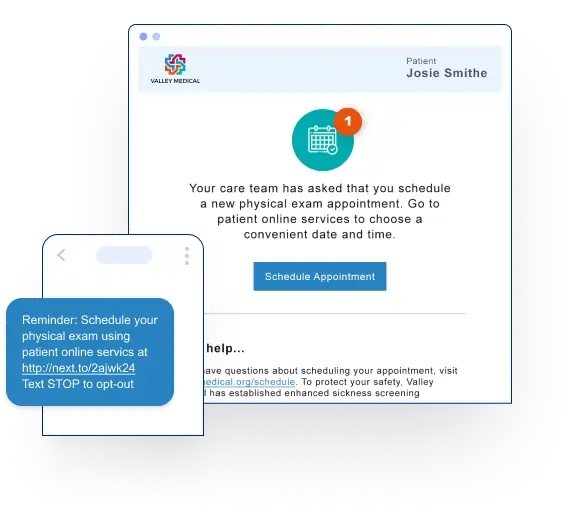

Catch customers on the go by integrating your print communications with email and text messaging.

Deliver personalized messages to your customers like never before.

Manage inbound and outbound transactions with a single platform.

Customize the content and layouts for all your messaging, and seamlessly move your existing communications to your new platform.

Track the performance metrics of your CCM programs with both standard and customized options for real-time reporting.

Deliver communications on an individual basis through channels such as print, email, SMS, personalized videos and online viewing.

Ensure your CCM platform can integrate smoothly with your current enterprise system to synchronize with current customer information.

Work with our consultative teams to reduce costs and streamline delivery of your communications by increasing your e-adoption performance.

Take complete control of an end-to-end process that includes content creation, approvals, version control, scheduling and delivery.

Outsourcing print operations drastically reduces overhead costs.

Digital transformation, labor management and disaster recovery options are leading companies with in-plant operations to reassess their approach.

The requests to shift print production to Taylor have increased.

Customer stress levels decreased as supply chain management shifted to Taylor.

Investments that typically went into internal print were freed up to use elsewhere.

Your source for success stories, design and delivery strategies, and all things CCM.

See what sets Taylor apart with everything from cost savings, supply chain stability and compliance expertise to omnichannel communications and the platforms to deliver them.

Free up time and money to focus on software development by working with a print provider that specializes in secure customer communications.

Here is a buyer’s guide to help you compare your options and needs when it comes to choosing a partner to develop and deliver your secure communications.

For both hospitals and health systems, maintaining compliance and securely delivering private communications is a full-time job.

Create lasting customer experiences with our award-winning services and solutions.

Maintain the security of customer data and the accuracy of statements, invoices and notifications.

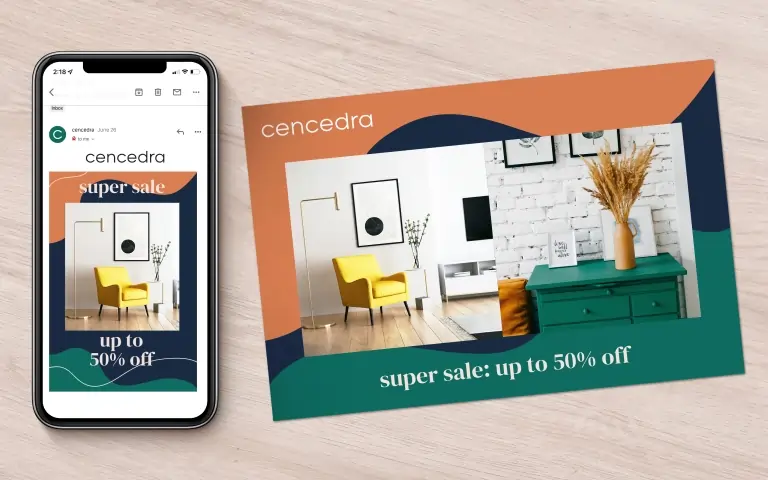

Use customer communications to spread brand awareness and increase customer engagement.

Reach customers with relevant and engaging communications at the right time.

Customer communications management is the overarching term for the strategy, processes and tools used to deliver consistent communications to customers through multiple channels.

CCM includes the composition, design and personalization of communications such as bills, invoices, statements, marketing and promotional materials, notifications and other documents, as well as the secure storage, delivery and tracking of these communications.

CCM often utilizes an omnichannel approach, in which communications can be accessed by the recipient through several channels of communication, including print, digital, mobile and social media, while ensuring the recipient has a consistent brand experience regardless of the channel in which they are interacting with you.

A customer communications management program has to include these four capabilities:

It’s important that your CCM software and the tools within are able to provide you with these capabilities.

CCM software is a collection of programs that allows users to compose, design, personalize, and both securely store and deliver customer communications. The tools included in CCM software allow the user to manage data, content, multiple delivery channels, personalization, automation processes, and compliance regulations and security.

Data Integration: Consolidate information from multiple sources, such as customer relationship systems (CRM), databases and customer histories. This is used to personalize customer communications based on the recipient’s preferences and behaviors.

Content Management Systems: Design, edit, store and deliver content with consistent messaging and branding across the channels you’re using for the delivery of your customer communications.

E-Adoption: Update existing content and communications to be sent electronically. Digital alternatives to printed communications can help you maximize accuracy and cut down on costs.

Omnichannel Delivery: Provide seamless customer experiences across multiple touchpoints. The choice of channel can be based on the type of communication being sent or customer preference, but branding and messaging will stay consistent across all channels, including print, email, SMS, web, mobile, social media and more.

Personalization: Customize communications using customer preferences as well as past customer data. Personalized messages, offers and notifications only enhance your reputation and the level of trust with your customer base.

Workflow Management: Automate and streamline communication processes. Workflow management tools let you approve designs, schedule and track campaigns, and learn in real time what is working and what is not.

Compliance and Security: With privacy and security being paramount in the world of CCM, your systems should have features to help you keep up with compliance and regulatory guidelines depending on the industry and communication being sent.

Both CRM and CCM manage interactions with customers, but they focus on different areas of the customer experience.

CCM encompasses the strategies and tools used to store, deliver and personalize individual communications.

CRM takes a broader approach, utilizing the technologies and practices to manage relationships with customers over the entire customer lifecycle. CRM also involves collecting and analyzing the customer data and preferences that are used to develop more effective and relevant customer communications.

Neps and Venture combine to give you a full suite of customer communications management solutions.

Neps focuses on the development and design of your communications.

Neps partners with you on document composition, version controls and personalization. Neps platforms provide real-time design tools, templates and workflow controls that allow for content rationalization, reporting and everything else needed to ensure the best document layout and design for your communications.

Venture sees that your documents are produced accurately and delivered securely.

For electronic communications, this means Venture provides best-in-class data solutions that allow you to give your customers an omnichannel experience through synchronized channels including email, text and mobile apps.

With printed communications, Venture provides full-color, variable and digital printing options alongside a comprehensive suite of finishing services. Venture can also help you with e-adoption, converting older documents to digital formats to save on print and postage.